Updated: 19 Jan 2026

Singapore has consistently ranked among the top global destinations for business. According to the World Bank’s Ease of Doing Business Index, Singapore was consistently ranked #2 globally, recognised for its transparent regulations, efficient government processes, and strong legal system. Each year, tens of thousands of new businesses are registered, reflecting the city-state’s role as a regional hub for trade, finance, and innovation.

Incorporating a company offers advantages that informal or unregistered businesses cannot match. A registered entity enjoys legal recognition, separate liability, and enhanced credibility when dealing with banks, clients, and government agencies. In contrast, remaining unregistered exposes business owners to personal liability risks and limits opportunities for growth.

This guide provides a comprehensive step-by-step breakdown of the company incorporation process in 2026. Whether you are a local entrepreneur or a foreign founder exploring opportunities in Singapore, the following sections cover everything from selecting a structure and preparing documentation to completing the incorporation and understanding associated costs.

[Get your company registered in Singapore with full compliance today!]

Advantages of Incorporating a Business in Singapore

Singapore is widely regarded as one of the most pro-business jurisdictions in the world. Entrepreneurs who incorporate here benefit from:

1. A trusted legal and regulatory environment

Singapore’s judicial system is internationally respected, providing a stable and enforceable framework for contracts, intellectual property (IP) protection, and corporate governance.

2. Competitive and transparent tax regime

With a flat 17% corporate tax rate and targeted start-up tax exemptions, Singapore offers one of the most competitive tax structures in Asia. The absence of capital gains tax and the presence of double-taxation treaties with numerous countries further enhance its attractiveness.

3. Strategic location and access to markets

Positioned at the heart of Southeast Asia, Singapore provides immediate access to ASEAN’s 600+ million consumers and serves as a gateway to China, India, and other major economies.

4. Government support and funding

The government actively promotes entrepreneurship with initiatives such as Startup SG, Enterprise Development Grants, and sector-specific incentives for technology, sustainability, and innovation-driven enterprises.

5. Credibility and investor confidence

A Singapore-incorporated company signals trustworthiness to clients, banks, and venture capital investors. It allows businesses to open corporate bank accounts easily, secure funding, and qualify for tenders or grants that are not available to unregistered entities.

Types of Business Structures in Singapore

Choosing the correct business structure is one of the most important pre-incorporation decisions. Below is an overview of the main structures available:

-

Sole Proprietorship

-

Owned by a single individual.

-

Easy and inexpensive to set up.

-

The owner is personally liable for all debts and obligations.

-

Not recommended for businesses seeking growth or external investment.

-

Partnerships (General Partnership, Limited Partnership, Limited Liability Partnership – LLP)

-

Involves two or more partners.

-

General Partnership: partners bear unlimited liability.

-

Limited Partnership (LP): includes at least one general partner (unlimited liability) and one limited partner.

-

LLP: gives partners limited liability and separate legal status, often used by professionals such as law or accounting firms.

-

Private Limited Company (Pte Ltd)

-

The most common and preferred structure.

-

Separate legal entity with limited liability.

-

Allows for shareholding by individuals or corporate entities (local or foreign).

-

Eligible for government grants, tax exemptions, and investment opportunities.

-

Scalable and ideal for long-term growth.

-

Company Limited by Guarantee (CLG)

-

Not-for-profit structure commonly used by charities, professional associations, or clubs.

-

Instead of shareholders, members guarantee a nominal amount in case of winding up.

-

Branch, Subsidiary, and Representative Office (for foreign companies)

-

Subsidiary: a locally incorporated Pte Ltd, typically with the foreign parent company as shareholder. Offers limited liability and full access to local tax benefits.

-

Branch Office: an extension of the parent company, not a separate legal entity. The parent company is liable for obligations.

-

Representative Office: temporary arrangement for market research or liaison purposes. Cannot generate revenue.

| Structure | Legal Status | Liability | Tax Treatment | Scalability & Grants |

|---|---|---|---|---|

| Sole Proprietorship | Not separate | Unlimited liability | Personal tax rate | Limited |

| Partnership | Not separate (except LLP) | Unlimited (except LLP) | Personal/corporate depending on type | Limited |

| Private Limited (Pte Ltd) | Separate entity | Limited liability | 17% corporate tax, eligible for exemptions | High |

| Company Limited by Guarantee | Separate entity | Limited liability | Exempt/charitable rules | Not profit-driven |

| Subsidiary | Separate entity | Limited liability | Full corporate tax benefits | High |

| Branch Office | Extension of parent | Parent liable | Parent company taxation | Limited |

| Representative Office | Not separate | N/A (no commercial activity) | N/A | Temporary |

Incorporate your Singapore company smoothly with Margin Wheeler’s end-to-end support!

Key Requirements Before Incorporation Your Business

Before submitting an application to ACRA, you must prepare and satisfy several statutory requirements:

1. Company name

-

Must not be identical to an existing entity or contain obscene/restricted terms.

-

Reserved online via BizFile for S$15. Reservation is valid for 120 days.

2. SSIC code

-

Businesses must classify their activities using the Singapore Standard Industrial Classification (SSIC) code.

3. Shareholders

-

At least one shareholder is required. Shareholders can be individuals or corporate entities, local or foreign.

4. Directors

-

At least one local resident director is required. This includes Singapore citizens, permanent residents, or foreigners with valid passes such as EntrePass or Employment Pass (subject to MOM approval).

5. Company secretary

-

Must be appointed within six months of incorporation.

-

The secretary must be a natural person and resident in Singapore.

6. Share capital

-

Minimum paid-up capital is S$1. This can be increased later as needed.

7. Registered office

-

Must be a physical Singapore address (P.O. boxes are not accepted).

-

Home office use is allowed with HDB or URA approval under the Home Office Scheme.

8. Company constitution

-

Governs the company’s rules and operations.

-

You may adopt ACRA’s model constitution or create a customised version.

9. KYC documentation

-

For individuals: passport/NRIC, proof of residential address.

-

For corporate shareholders: certificate of incorporation, business profile, and board resolution approving investment.

Understanding Company Incorporation Process in Singapore

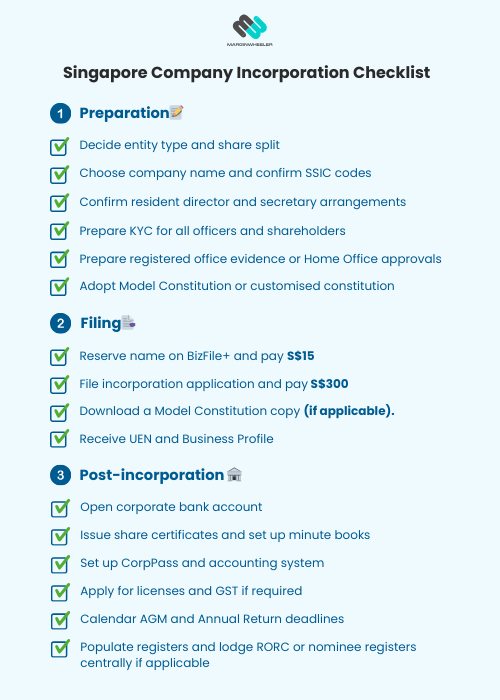

In Singapore, company incorporation is regulated by the Accounting and Corporate Regulatory Authority (ACRA) through its BizFile+ system. The process is highly digitalised and efficient, allowing most straightforward applications to be approved within a day. While every case involves its own details, the incorporation generally follows these stages:

Step 1: Name approval

A proposed company name is submitted to ACRA for clearance. Names that are unique and comply with the guidelines are approved quickly, while those containing regulated terms may take longer as they require review by additional authorities.

Step 2: Preparation of documents

Before filing, essential statutory documents must be prepared. These include the company constitution, shareholder and director consents, and supporting identification documents.

Step 3: Submission to ACRA

Once documentation is complete, the application is lodged electronically with ACRA. This formal filing records the details of shareholders, directors, and the company secretary.

Step 4: Payment of government fees

The statutory fees include S$15 for name application and S$300 for incorporation.

Step 5: Issuance of company documents

If the application is successful, ACRA issues an electronic Certificate of Incorporation, assigns a Unique Entity Number (UEN), and generates a Business Profile. These serve as official proof of the company’s existence and are often required for subsequent steps such as opening a corporate bank account.

How long does it take to incorporate a business in Singapore?

In most uncomplicated cases, the entire process can be completed within one business day, though more complex applications may take longer if reviews are required.

Costs of Company Incorporation in 2026

The cost of setting up a company in Singapore goes beyond the statutory filing fees charged by the Accounting and Corporate Regulatory Authority (ACRA). While ACRA itself collects only S$315 for incorporation (including the application and registration fees), most businesses rely on professional service providers to ensure compliance and a smoother process.

A typical incorporation package in Singapore often includes:

-

Incorporation essentials: Company name reservation, issuance of the Unique Entity Number (UEN), adoption of the standard constitution, and initial statutory register maintenance.

-

Corporate secretary support: Appointment of a qualified company secretary, preparation of the first board resolution, and issuance of share certificates to shareholders.

-

Business profile and bank setup: Delivery of the official business profile from ACRA and guidance with opening a corporate bank account.

-

Ongoing advisory: Access to compliance guidance, especially during the crucial first year of operation.

Additional charges may apply depending on a company’s circumstances, such as drafting a customised constitution, appointing a nominee director for foreign-owned entities, or registering for Goods and Services Tax (GST).

In practice, most incorporation service packages in Singapore fall within the S$800–S$2,000 range, depending on whether the company is locally or foreign-owned and what level of support is included. While the ACRA fee is fixed, the additional services bundled into a package represent the real difference in total cost, such as secretarial compliance, registered address, or nominee director arrangements.

By considering incorporation costs as more than just a one-time filing fee, new business owners can budget more realistically for their first year of operations. This ensures not only a smooth registration process but also that statutory obligations are properly met from day one.

Understanding GST and Corporate Taxes for New Companies

Tax compliance is a central part of corporate life in Singapore. While the system is straightforward compared to many jurisdictions, every new company should understand its basic obligations.

Goods and Services Tax (GST)

GST is Singapore’s value-added tax on most goods and services. Registration becomes compulsory if your company’s taxable turnover:

-

Exceeds S$1 million over the past 12 months (retrospective basis); or

Is reasonably expected to exceed S$1 million in the next 12 months (prospective basis).

Failure to register on time can result in penalties, so it is important to monitor turnover closely.

Corporate Income Tax

Singapore levies a flat 17% corporate tax rate, one of the most competitive in the region. Newly incorporated companies may qualify for the Start-Up Tax Exemption Scheme, which offers significant relief on the first three consecutive Years of Assessment (YA). After that, the Partial Tax Exemption Scheme applies to reduce the effective tax burden on lower bands of chargeable income.

Planning your financial year-end early is recommended, as this determines filing deadlines with the Inland Revenue Authority of Singapore (IRAS). Proper bookkeeping from the outset helps prevent complications when annual filings are due.

Margin Wheeler can assist with GST registration, advise on which tax exemptions apply to your company, and align your tax calendar with your corporate filing obligations.

Annual Compliance Obligations For Singaporean Companies

Once incorporated, companies must maintain good standing through timely statutory compliance. The key requirements include:

Annual General Meeting (AGM)

Unless exempted, companies are required to hold an AGM every year. Private companies can sometimes dispense with physical AGMs if shareholders pass written resolutions, but financial statements must still be prepared and circulated within statutory timelines.

Annual Return (AR)

Every private limited company must file its Annual Return with ACRA within seven months after the financial year-end. This is separate from the company’s corporate tax return to IRAS. Even companies that are dormant or not actively trading must file an AR if they remain on the register.

Auditor Appointment

Unless exempt under the “small company” audit exemption criteria, companies must appoint an auditor within three months of incorporation.

Updating Registers

Changes in directors, secretaries, auditors, or share capital must be lodged with ACRA within 14 days of the change.

Registered Office Requirements

Your registered office must remain accessible to the public for at least three hours during business days. Any change of address must be filed with ACRA within 14 days.

Key Considerations For Foreign Entrepreneurs

Singapore is highly open to foreign ownership. A Pte. Ltd. company can be 100% foreign-owned, making it one of the easiest jurisdictions for international entrepreneurs to establish a presence.

However, there are mandatory requirements:

-

Every company must have at least one locally resident director at all times.

-

Many overseas founders appoint a nominee director through a corporate service provider when they do not yet reside in Singapore.

-

If relocating, a founder may apply for a work pass such as an Employment Pass or EntrePass. Once approved, they may assume the role of resident director themselves.

Margin Wheeler offers company incorporation services for foreigners too, learn more here!

Common Pitfalls That Delay or Complicate Incorporation

Even though Singapore’s incorporation framework is efficient, companies can face delays or rejections if common mistakes are made. These include:

1. Problematic name choices

Names containing regulated terms (e.g., “finance,” “school”) may trigger review by other authorities and add weeks of delay if supporting approvals are not ready.

2. Resident director misunderstandings

Foreign pass holders sometimes assume they can be appointed before eligibility is confirmed. Always verify pass conditions before proceeding.

3. Failure to appoint a company secretary

The secretary must be appointed within six months, and the role cannot be combined with the sole directorship.

4. Registered office breaches

Offices that are not open to the public for the required hours or without proper approval (in the case of home offices) risk compliance issues.

5. Neglecting statutory registers

From 16 June 2025, companies must lodge details of the Register of Registrable Controllers (RORC) and nominee directors/shareholders centrally with ACRA. Failure to comply may lead to penalties.

6. Missed endorsements

Directors and officers must endorse their appointments within 60 days of ACRA’s notice, or the application lapses.

Frequently Asked Questions

1. How much does it cost to incorporate?

Officially, ACRA collects S$315 in government fees. However, additional expenses apply for services such as secretarial support, registered address, nominee directors, and bookkeeping.

2. Can I start with S$1 share capital and increase later?

Yes. Many companies start with S$1 to incorporate quickly, then increase their capital once a bank account is open or investors subscribe.

3. Do I need to issue share certificates?

Yes. Certificates should be issued to all shareholders and kept with the company’s minute books and registers. Updates must also be filed in BizFile+ to ensure the electronic register of members is current.

4. Do I need a physical office?

Yes. Every company must have a registered office in Singapore that is open for at least three hours during business days. Home offices are allowed with HDB or URA approval.

5. When must I register for GST?

If your taxable turnover exceeds S$1 million in the past 12 months, or is expected to exceed that threshold in the coming 12 months, you must register for GST with IRAS.

6. What if I am overseas and have no resident director?

You can appoint a nominee director through a corporate service provider. If you later obtain a valid work pass and relocate, you may then serve as the local director yourself.

While it’s possible to incorporate a company on your own by following the steps above, many entrepreneurs prefer to save time and avoid mistakes by engaging a professional filing agent. Don’t want the hassle of doing it yourself?

Incorporate Your Company with Margin Wheeler!

Incorporating a company in Singapore is a streamlined process, but compliance does not end once the Certificate of Incorporation is issued. To remain in good standing, every company must maintain a resident director, a registered office, a qualified secretary, updated statutory registers, and timely filings of AGMs and Annual Returns.

By understanding these core requirements and planning for them from the outset, entrepreneurs can concentrate on growth rather than administrative challenges.

Margin Wheeler supports clients throughout this journey from the initial registration to ongoing compliance. With professional guidance, your business can navigate Singapore’s corporate framework confidently and focus on building long-term success. Incorporate your company in Singapore with us today!